Sansera Engineering Limited IPO Details, Subscription and GMP

Details of the Sansera Engineering Limited IPO:

- Issue Amount: Upto ₹1,282.98 Cr (100% Offer For Sale)

- Total shares on offer: Upto 17,244,328 Equity Shares

- Face Value : ₹2 per share

- Price Band : ₹734 to ₹744

- Lot Size : 20 shares

Important dates for Sansera Engineering Limited IPO:

- IPO Open: Tuesday, September 14, 2021

- IPO Close: Thursday, September 16, 2021

- Finalization of basis of allotment: 21 September 2021

- Refunds/Unblocking ASBA fund: 22 September 2021

- Credit of equity shares to DP account: 23 September 2021

- Trading commences: 24 September 2021

Company Background:

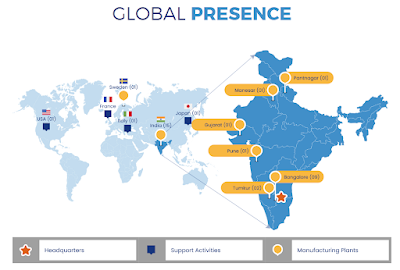

Sansera was incorporated in 1981 in Bengaluru and commenced commercial production of passenger vehicle components in 1986. Sansera grew their precision components manufacturing business organically in India by commencing supplies to the two-wheeler vertical in 1996, for off road vehicles in 2009, and to the light commercial vehicle vertical in 2011. They set up a manufacturing facility dedicated to high precision aluminium and titanium machined aerospace components in 2013. In April 2017, they acquired a 100% stake in Sansera Sweden, which has facilitated sensera entry into the heavy commercial vehicle vertical in the automotive sector, expanded our customer base and improved geographical access to OEMs outside India.Source: official Website Sensera

Strengths Of Sansera Engineering Limited

- Leading supplier of complex and high-quality precision engineered components across automotive and non-automotive sectors which are poised to grow strongly.

- A well-diversified portfolio of segments, products, customers, and geography.

- Strong Engineering & Designing capabilities.

- Strong relationships with respected Indian and Global OEM’s.

- Strong financial performance.

Source: RHP

Financial Details of Sansera Engineering Limited IPO:

Purpose of the Sansera Engineering Limited IPO:

To carry out the Offer for Sale of up to 17,244,328 Equity Shares by the Selling Shareholders; andachieve the benefits of listing the Equity Shares on the Stock Exchanges.

Grey Market Premium Sansera Engineering Limited IPO:

On 16th September 2021, Sansera Engineering share's premium tanked from Rs. 75 to Rs. 15 in the grey market. which is around 2% to its Issue price of Rs. 744/-.Sansera Engineering Limited IPO Subscription on 16th September 2021:

The Sensera Engineering limited IPO is subscribed 5.18 times on 16th Sept 2021 2:30 pm

- Qualified Institutional Buyers (QIB) - 12.50 times Subscribed

- Retail Individual Investors (RII) - 2.70 times Subscribed

- Non Institutional investors (NII) - 1.42 times Subscribed

- Employee - 1.29 times Subscribed

Comments

Post a Comment