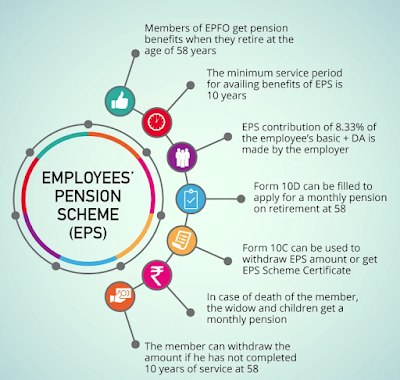

What Is Employees’ Pension Scheme (EPS) In Employee Provident Fund

EPF pension scheme was launched by the government in 1995 and, hence, is also called the Employees Pension Scheme 1995. It includes both new as well as existing EPF members. The EPS pension scheme has certain arrangements in place if a member wants to withdraw pension funds. Contents What is EPS Eligibility criteria for EPS Different EPS and EPF pension types EPS Pension forms details Process to check EPS balance Calculation and Withdrawal of EPS What is EPS (Employees’ Pension Scheme) The EPS is a scheme by the Employee’s Provident Fund Organization (EPFO), which aims at social security. This scheme is for the pension of the employees working in the organized sector, after their retirement at 58 years. The advantages or benefits of this scheme are only to be availed if the employee has served for a minimum of (continuous or non-continuous) 10 years. EPS pension was made available from 1995 and later retained for existing and newly joined EPF employees since. Eligibility criteria for E