What Is Employees’ Pension Scheme (EPS) In Employee Provident Fund

Contents

- What is EPS

- Eligibility criteria for EPS

- Different EPS and EPF pension types

- EPS Pension forms details

- Process to check EPS balance

- Calculation and Withdrawal of EPS

What is EPS (Employees’ Pension Scheme)

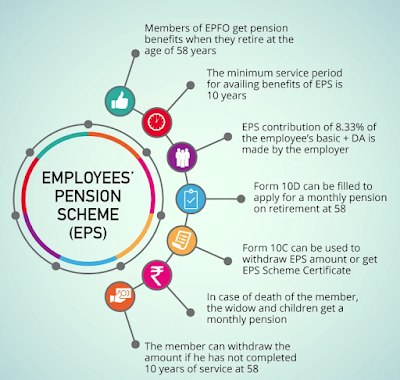

The EPS is a scheme by the Employee’s Provident Fund Organization (EPFO), which aims at social security. This scheme is for the pension of the employees working in the organized sector, after their retirement at 58 years.The advantages or benefits of this scheme are only to be availed if the employee has served for a minimum of (continuous or non-continuous) 10 years. EPS pension was made available from 1995 and later retained for existing and newly joined EPF employees since.

Eligibility criteria for EPS

To avail the benefits of pension under the Employees’ Pension Scheme, the person should meet the following eligibility conditions.- The individual should be an EPFO member

- Complete 10 years of active service along with equal years of active contribution towards the EPF pension Scheme

- Be 58 years or above

- Have attained at least 50 years of age to withdraw from the EPS pension at a lower rate

- Delay withdrawing the pension for by 2 years, i.e., till he or she is 60 years, to become eligible to get EPS pension at a rate of 4% annually

Different EPS and EPF pension types

Widow pension

Also known as Vridha pension, wherein, a widow of the deceased EPFO member is eligible for this pension. The pension is paid to the widow until her death or remarriage. In case of more than one widow, the pension value is paid to the oldest widow.The amount for a monthly payout of the widow pension is calculated according to Table C of the Employees Pension Scheme 1995. As on date, the minimum pension amount has been increased to INR 1,000.

Child pension

Under child pension, If the EPS member is deceased, their surviving children become applicable to receive a monthly pension from the pension contribution in EPF. This is in addition to the widow pension to the deceased’s wife. The monthly payouts will be applicable until the child turns 25 years old. The pension can be paid to a maximum of two children and the payable amount is 25% of the widow pension amount.Orphan pension

If the EPFO member dies and does not have any surviving widow, then his children are entitled to receive a pension under the orphan EPF pension scheme. Under this, the orphan or orphans receive 75% of the widow pension monthly.Reduced pension

An EPF pension scheme member can withdraw early pension if he or she has attained the age of 50 but is less than 58 years old, and, if they have made an active pension contribution in EPF for 10 years or more. In such cases, the pension value is reduced to a rate of 4% per year until the employee reaches the age of 58 years.For example: if an EPF pension member, who is 56 years of age, wishes to withdraw reduced pension monthly, then he or she will get the payouts at the rate of 92% of the original pension amount. It is calculated as 100% – (2*4) = 92%.

EPS Pension forms details

An EPFO member of the survivor has to fill various EPS forms depending on their eligibility criteria to avail the benefits of the Employees’ Pension Scheme.Form 10C

The Employees’ Provident Fund (EPF) is a retirement benefit as per the EPFO Act 1995, wherein, the member invests part of his salary every month and the employer makes an equal pension contribution in PF towards his/her EPS pension account. When a member switches jobs, he/she can transfer the EPF amount to a new account or withdraw the amount by submitting an EPS scheme certificate and filling the necessary EPS form. EPS Form 10C, however, can be used to withdraw the accumulated pension amount after a continuous service of 180 days and before the completion of 10 years of active service.Form 10D

Form 10D is the general form that a member needs to fill to withdraw monthly pension after the age of 50 years. This EPS form can also be filled to withdraw monthly child pension and widow pension too.Life certificate

Life certificate has to be submitted in November every year by the member or the beneficiary of the pension to certify that he or she is still alive. This form should be submitted in person by the beneficiary to the branch manager of the bank with the active pension account details.Non-remarriage certificate

This form is a declaration that the widow/widower of the pensioner has not remarried. This declaration has to be submitted every year in November by the widowed individual. The widow will have to furnish this certificate once at the time of the commencement of the pension.

Pension benefits under EPS

Eligible EPS pension members can avail the benefits of the pension according to the age from which they start the withdrawals. For different cases, the value of the pension is also different.

Pension on absolute disablement

If the EPFO member becomes completely and permanently disabled, then he/she is qualified to receive monthly pensions, irrespective of them not having served the minimum service period required to get monthly pensions. Their employer must deposit EPF minimum pension funds into their EPF account for a minimum of 1 month for them to become eligible for this pension.

A member can avail the pension benefits monthly from the very date of disablement and get paid for his/her lifetime. But, the member has to take a medical test to ascertain that he/she is not fit for the work that they were doing before getting disabled.

Pension at 58 years

The member is eligible for the benefits of pension after his/her retirement, that is, after 58 years of age. However, for this, they should have compulsorily made an active pension contribution in EPF for 10 years, at least, before their retirement to avail the pension benefits. Post-retirement, the EPS pension scheme certificate gets generated. This certificate is required to fill up form 10D to withdraw the pension monthly.Pension on discontinuing service without fulfilling the criteria

If the member discontinues service or is unable to stay in duty for 10 years prior to 58 years of age, he/she could withdraw the entire amount once they attain 58 years of age by furnishing form 10C.Pension on absolute disablement

If the EPFO member becomes completely and permanently disabled, then he/she is qualified to receive monthly pensions, irrespective of them not having served the minimum service period required to get monthly pensions. Their employer must deposit EPF minimum pension funds into their EPF account for a minimum of 1 month for them to become eligible for this pension.

A member can avail the pension benefits monthly from the very date of disablement and get paid for his/her lifetime. But, the member has to take a medical test to ascertain that he/she is not fit for the work that they were doing before getting disabled.

Pension if the member is deceased

The family of the EPFO member becomes eligible to receive the EPS pension (or, EPF pension) in the below-mentioned cases.

- If the EPFO member dies after the commencement of monthly pension

- If the EPFO member dies before the age of 58 but has completed the 10 minimum years of active service contribution

- If the member dies in the service duration and the company or employer has deposited pension funds in the members EPF account for a minimum of 1 month

What happens to the EPS amount in case of a change in jobs?

Previously, while switching employment, you had to submit out two forms:- Form 11 to certify that you are a member of Employees’ Provident Fund (EPF) schemes

- Form 13 to have your PF balance moved from the previous company to the current one.

If you have an existing Universal Account Number (UAN) and your Aadhaar is validated for KYC in the EPF database, a composite Form 11 can now fulfil both functions. Everyone else must still complete Forms 11 and 13.

How Does Employee Pension Scheme Work?

Employees’ Pension Scheme (EPS), often called EPF Pension, is a social security scheme administered by the Employees’ Provident Fund Organisation (EPFO). The system provides for a pension after retiring at age 58 for employees who work in the organized sector. Nevertheless, the scheme’s perks are only available if the worker has worked for the company for at least 10 years (the service doesn’t have to be continuous).EPS was introduced in 1995, and it enabled both new and existing EPF members to participate. Both of the contracting parties contribute 12% of the employee’s wage to the EPF. Every month, the employee’s complete part is given to the EPF, 8.33% of the employer’s portion is donated to the Employees’ Pension Scheme (EPS), and 3.67% is contributed to the EPF.

The process to check EPS balance

Step 1: Visit the official EPFO portalStep 2: Under the “Services” dropdown menu in the top left corner click on “For Employees”

Step 3: Then click on “Member Passbook” under Services

Step 4: On the member passbook portal click on the “Login” button after entering your UAN, password, and solving captcha.

Step 5: “Select Member Id” from the dropdown and click on the “View Passbook” button on the right to display all the pension contributions by the employer till date and the total EPS balance. Alternatively, you can download a PDF version of the same by clicking on the “Download Passbook” button.

In this Passbook you will see the Pension contribution coloumn.

Calculation of EPS

The monthly EPS or pension amount an employee receives after retirement is based on the pensionable service and pensionable salary. It is calculated as per the following formula

Pensionable Salary: The average monthly salary received by an individual in the last 60 months, before he/she decides to exit the Employees’ Pension Scheme.

Pensionable Service: It is the service period — or the duration of employment — of an individual. It is calculated as the total of service periods under different employers. In the event of a job switch, the individual must obtain an EPS Scheme certificate and hand it over to the new employer.

As mentioned earlier, this pension fund can be withdrawn prematurely, but only after the employee has served a term of ten non-continuous years of service. This fund is taxable, and various tax benefits can be availed on the consolidated amount.

Pensionable Service: It is the service period — or the duration of employment — of an individual. It is calculated as the total of service periods under different employers. In the event of a job switch, the individual must obtain an EPS Scheme certificate and hand it over to the new employer.

As mentioned earlier, this pension fund can be withdrawn prematurely, but only after the employee has served a term of ten non-continuous years of service. This fund is taxable, and various tax benefits can be availed on the consolidated amount.

Comments

Post a Comment