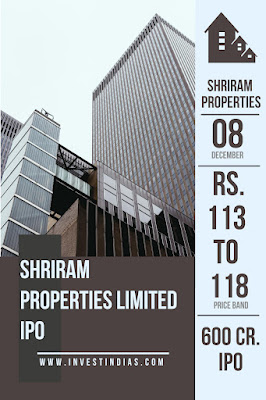

Shriram Properties Limited IPO Details and Grey Market Premium (GMP)

Key Points of the Shriram Properties Limited IPO

- Issue Amount : ₹ 600 Cr

- Face Value : ₹ 10 per share

- Price Band : ₹ 113 to ₹ 118

- Lot Size : 125 shares

- Issue break-up% : QIB: 75% NIB: 15% Retail: 10%

Important dates for Shriram Properties Limited IPO

- IPO Open : Wednesday, December 08, 2021

- IPO Close : Friday, December 10, 2021

- Finalization of basis of allotment : 15th December 2021

- Refunds/Unblocking ASBA fund : 16th December 2021

- Credit of equity shares to DP account : 17th December 2021

- Trading commences : 20th December 2021

Grey Market Premium of Shriram Properties Limited IPO

In the following data we can see how the Grey Market Premium of Shriram Properties Limited IPO varied in last few days

10th Dec - Rs. 1009th Dec - Rs. 20

08th Dec - Rs. 2007th Dec - Rs. 2006th Dec - Rs. 2005th Dec - Rs. 2004th Dec - Rs. 20

Shriram Properties Limited IPO Subscription on 10th December 2021

Shriram Properties Limited IPO is subscribed 1.87 times on 10th December 2021 12:00 pm

Qualified Institutional Buyers (QIB) - 0.12 times Subscribed

Retail Individual Investors (RII) - 9.63 times Subscribed

Non Institutional investors (NII) - 0.22 times Subscribed

Employee - 1.01 times Subscribed

Qualified Institutional Buyers (QIB) - 0.12 times Subscribed

Retail Individual Investors (RII) - 9.63 times Subscribed

Non Institutional investors (NII) - 0.22 times Subscribed

Employee - 1.01 times Subscribed

Shriram Properties Limited Company background

Shriram Properties Limited is one of the leading residential real estate development companies in South India, primarily focused on the mid-market and affordable housing categories. It is among the top five residential real estate companies in South India in terms of number of units launched between the calendar years 2012 and the third quarter of 2021 across Tier 1 cities of South India including Bengaluru, Chennai and Hyderabad. (Source: JLL Report) It is also present in the mid-market premium and luxury housing categories as well as commercial and office space categories in its core markets.The company commenced operations in Bengaluru in the year 2000 and has since expanded its presence to other cities in South India, i.e., Chennai, Coimbatore and Visakhapatnam. In addition, it also has a presence in Kolkata in East India, where it is developing a large mixed-use project. Bengaluru and Chennai are two key markets for the company. These cities are among two key residential housing markets in India, contributing to approximately 29.3% of the launches in India between the calendar year 2012 and the third quarter of calendar year 2021, and 28.7% of the sold inventory in India between calendar year 2019 and the third quarter of the calendar year 2021.

As of September 30, 2021, it has 29 Completed Projects, representing 16.76 million square feet of Saleable Area, out of which its 24 Completed Projects in the cities of Bengaluru and Chennai accounted for 90.56% of our Saleable Area. Further, 83.69% of its total Saleable Area for Completed Projects were in the mid-market category and affordable housing category (with mid-market and affordable categories accounting for 51.44% and 32.25% respectively), and the remainder in the commercial and office space and luxury housing categories, as of September 30, 2021. Additionally, plotted developments accounted for 33.41% and 34.67% of sales volumes during the six months ended September 30, 2021 and the Financial Year 2021, respectively. In addition, as of September 30, 2021, it has a total portfolio of 35 projects in Ongoing Projects, Projects under Development and Forthcoming Projects aggregating to 46.72 million square feet of estimated Saleable Area. Our portfolio consists of 26 Ongoing Projects, five Projects under Development and four Forthcoming Projects, which account for 56.28%, 17.71% and 26.01% of the total estimated Saleable Area, respectively, as of September 30, 2021.

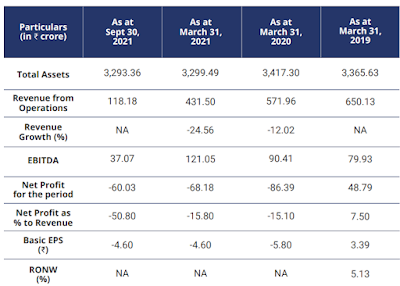

Financial Details of Shriram Properties Limited IPO

Disclaimer : This article is for educational purpose only and does not provide any buy or sell recommendation

👍

ReplyDeleteI generally want quality content and this thing I found in your article. It is beneficial and significant for us. Keep sharing these kinds of articles, Thank you. hoa management companies san antonio

ReplyDeleteIn Part II, I take up the fascinating topic of nails and screws and bolts. Dull, but VERY important. panele ścienne drewniane pionowe

ReplyDeleteYou made a very helpful article. I appreciate you blogging about it. I hope you keep having success. software development in chennai

ReplyDelete