One 97 Communications Limited IPO - Paytm IPO Details, GMP, Subscription and Issue Price

Details of the One 97 Communications Limited IPO - Paytm IPO:

- Issue Amount: ₹18,300 Cr (Fresh Issue - 8,300 Cr (45%) & Offer For Sale - 10,000 Cr (55%))

- Face Value : ₹1 per share

- Price Band : ₹2080 to ₹2150

- Lot Size : 6 shares

Important dates for One 97 Communications Limited IPO - Paytm IPO:

- IPO Open: Monday, November 08, 2021

- IPO Close: Wednesday, November 10, 2021

- Finalization of basis of allotment: 15th November 2021

- Refunds/Unblocking ASBA fund: 16th November 2021

- Credit of equity shares to DP account: 17th November 2021

- Trading commences: 18th November 2021

One 97 Communications Limited IPO - Paytm IPO Subscription on 9th November 2021:

The One 97 Communications Limited IPO - Paytm IPO is subscribed 0.48 times on 9th November 2021 17:00 pm- Qualified Institutional Buyers (QIB) - 0.46 times Subscribed

- Retail Individual Investors (RII) - 1.23 times Subscribed

- Non Institutional investors (NII) - 0.05 times Subscribed

Company background:

Incorporated in 2000, One 97 Communications Ltd is India's leading digital ecosystem for consumers as well as merchants. As of March 31, 2021, the company has a 333 million+ client base and 21 million+ registered merchants to whom it offers payment services, financial services, and commerce and cloud services.In 2009, the company launched the first digital mobile payment platform, "Paytm App" to offer cashless payment services to customers and now, it became India's largest payment platform and the most valuable payments brand with a total brand value of US$6.3 billion as per Kantar BrandZ India 2020 Report. The app enables customers to do cashless transactions at stores, top-up mobile phones, online money transfers, pay bills, access digital banking services, purchase tickets, play games online, buy insurance, make investments, and more. However, merchants can use the platform for advertising, online payment solutions, offering products to customers, and loyalty solutions.

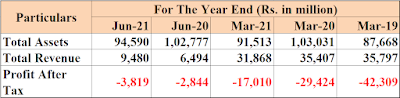

Financial Details of One 97 Communications Limited IPO - Paytm IPO:

Purpose of One 97 Communications Limited IPO - Paytm IPO:

- Growing and strengthening Paytm ecosystem, including through acquisition and retention of consumers and merchants and providing them with greater access to technology and financial services - ₹ 4,300 Crores

- Investing in new business initiatives, acquisitions and strategic partnerships - ₹ 2,000 Crores

- General corporate purposes

Grey Market Premium of One 97 Communications Limited IPO - Paytm IPO on 9th Nov 21:

On 9th Nov 2021, One 97 Communications Limited IPO - Paytm IPO share's premium is around Rs. 55 in the grey market. which is around 2.5% to its Issue price of Rs. 2150/-.

Comments

Post a Comment