New Solution to Home Loan EMIs! Its Good EMI

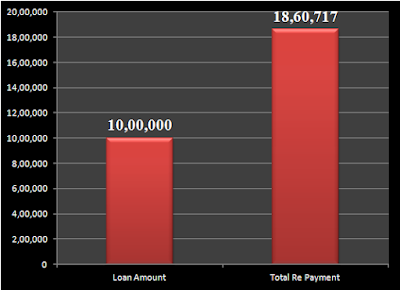

If you take a home Loan of 10 Lakh for a term of 20 years at an interest rate of 7% p.a., you will pay an EMIof approx 7,750 per month

And hear is how much you will end up repaying in 20 Years

Total Interest Paid : 8,60,717/-

You will end up paying Rs. 18,60,717/- in 20 years.

All though it feels bad, most of us don't have an option but to avail Loan to meet such immediate financial needs.

Hence,we borrow and start paying EMls which is inefficient as we pay more than we borrow.

Hence,we borrow and start paying EMls which is inefficient as we pay more than we borrow.

But here is a smart solution to recover much more than the extra paid amount. And Here Is How!

its Called Good EMI.

Have you Ever heard of Good EMI?

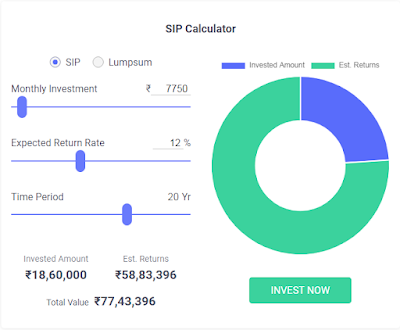

Let's say you invest a similar amount of Rs. 7,750/- per month for 20 years in equity mutual funds. Assuming a return of 12% p.a, you may end up with almost 77.5 Lakh.Isn't it Surprising? Yes It is.

|

| Source: Groww SIP calculator |

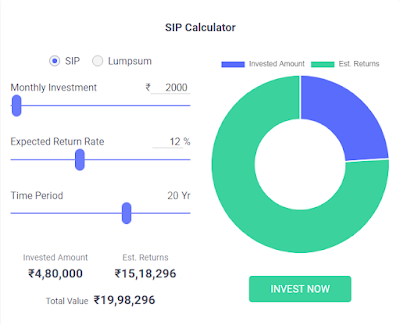

In fact, an investment of only 2,000 per month for 20 years would grow to 19.98 Lakh (with return of 12% p.a). That's a profit of almost 15.18 Lakh over your total investment of 4.80 Lakh - more than sufficient to cover the interest of 8.60 Lakh paid on a home Loan of 10 Lakh.

|

| Source: Groww SIP Calculator |

Interesting Isn't it?

Well, this is what SIP (Systematic Investment Plan) in equity mutual funds could help you achieve - significantly higher returns than most other investment products over the Long term.

Investing a fixed amount monthly in equity mutual funds through SIP is the best way to accumulate wealth over time.

And that's why we call it a Good EMI for Wealth Creation!

And that's why we call it a Good EMI for Wealth Creation!

Those in need of mortgage brokers Oshawa should go to the website of Mortgage Intelligence. Mortgage Intelligence can help you get the lowest mortgage rates by connecting you with the finest private mortgage lenders. Their representatives may be relied upon to guide you through the process of buying a house.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete